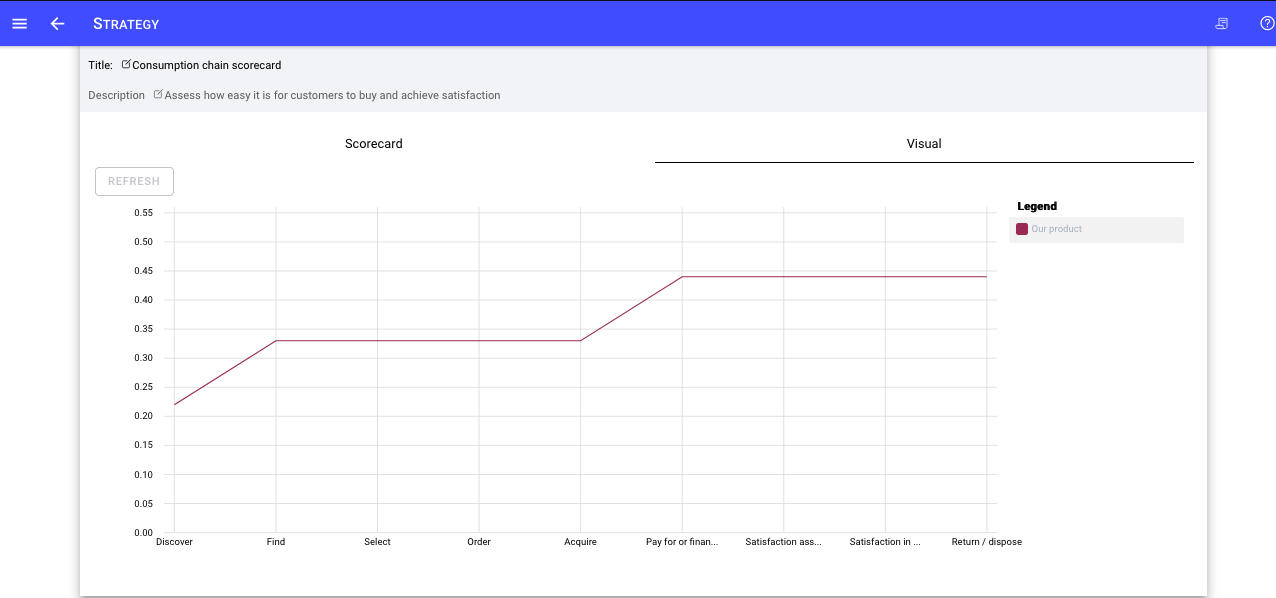

A crucial step in defining your where to play environment, and making it unique and reducing competition is to

-

identify who you can best serve or win with in a given market

-

ensure your business has the resources and capabilities to access the people in that market

-

then position your solutions so that they appeal to that market

Your business might be willing to serve a broader share of the market or even everyone, but there will be a subset of any market that your business can have the most success with.

You want to be as precise as you can, to enable the best use of your resources to win on that playing field. The tool you can use to make this choice precisely is the Market segment canvas. The Market segment canvas will enable you to consider the information at a strategic level related to defining a segment, identifying how your business will access and position your value proposition as superior to that segment. You can add as many segments to your canvas as you anticipate being able to serve and win with.

What is a market segment?

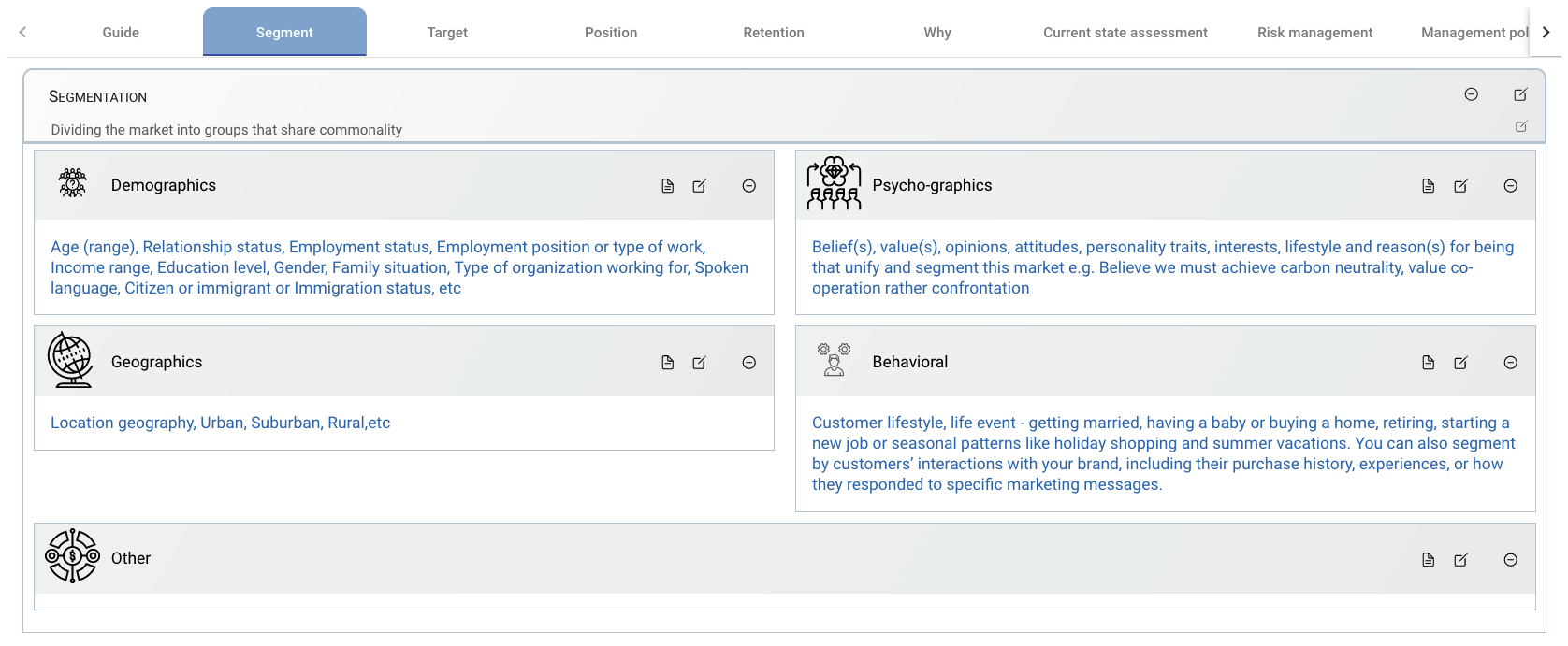

A market segment is a sub-section of any market / society. A market segment shares a common set of characteristics. It is that common set of characteristics that a business anticipates and ideally validates has the need or desire for its value proposition. When Louis Vuitton thinks about its market segment it is targeting those who are fashion conscious, have a desire to own, use and potentially demonstrate beautiful fashion and accessories and so forth. This is likely a very different sub-section of society to that being targeted by KIA the car company and McDonalds the restaurant. Segmentation can be done across multiple different and a combination of dimensions including:

Creating a market segment canvas

You can use the Market segmentation canvas to define a segment, assess its accessibility (targeting) and how to position your value proposition to that segment.

You can create a market segment canvas from the Which customers section of the canvas or from the side menu under the where to play section.

In all cases it is a person or people who make the choice to be willing to pay for and experience delight from your value proposition. So even if a business is trading B2B it still needs to offer people value and delight. Businesses do not buy products and services people do.

Why market segmentation

Market segmentation is a performance and productivity improvement tool.

It enables your business to be more efficient in terms of time,

money and other resources when communicating your offering,

your value proposition.

You can tailor your message, so it resonates with that customer segment.

If for example a business is selling Database management software,

then the message targeting technical personnel will be different to the

message communicated to C-suite executives.

The message must be different as the needs of the technical personnel are

different from those of C-suite.

Channels for communicating the message will also likely vary.

Technical personnel might be accessible via platforms such as Youtube,

Technology websites.

The C-Suite executives might be more accessible via direct sales,

business journals and so forth.

Market segmentation also allows companies to learn about their customers more specifically.

Getting feedback from the technical teams on your product is a focused set of feedback.

A better understanding of customer’s needs and wants allows focused

communications to each customer segment and product improvements most likely

to be valuable.

Demographic segmentation

Demographic segmentation is the segmentation of a population-based on factors you would expect in a government census including attributes such as age, race, and sex, employment, education, income, marriage or relationship status and more. Recalling the needs satisfied by your value proposition which demographic factors would identify the people in society that are mostly likely to have those needs?

Purchase behaviour-based segmentation

Purchase behaviour-based segmentation looks at how customers act differently throughout the decision-making process. It helps businesses understand:

How customers approach the purchase decision

The complexity of the purchasing process

The customer’s role in the purchasing process

Barriers along the path to purchase

Which behaviors are most and least predictive of purchase-making

Purchasing behaviour can be broken down into four main categories:

| Complex | Variety |

|---|---|

| A customer is highly involved in the purchasing and decision-making process, and there is a significant difference between the offers being considered. Examples include purchase of new luxury car, a new home, or a new Enterprise Resource Planning system for a fortune 500 company – a bad decision has ramifications | The customer isn’t too involved in the purchasing process, but there’s still a difference in the offers from different businesses. There is less at personal stake for the customer here and often the duration of the impact of the decision is shorter e.g., decided to try a new brand of coffee, pizza shop or similar. Businesses can enable this type of purchasing behaviour by providing trials, test drives, leases, rental arrangement and so forth to increase the confidence or decrease the durability of the decision. |

| Dissonance-reducing | Habitual |

| Customer is making an important purchasing decision, that could impact them personally, but they perceive the choices to be similar or undifferentiated. For example, when purchasing a new dining table, silverware set, or recruitment agency a customer might base their decision on price rather than the different attributes of the product | When a purchase doesn’t require much involvement, the product being offered doesn’t vary much across brands, and it’s mainly a personal preference or habit – the customer always buys that brand e.g. purchase the same laundry detergent or order pizza’s for the staff from the same nearby pizza shop. |

Buyer journey or stage

A frequent cause of losing customers is to seek a commitment when it is too early in the relationship,

a bit like popping the engagement ring into the champagne glass on the first or second date (without being a teenage Hollywood celebrity).

The aim of Buyer journey stage segmentation is present value proposition

to the prospective customer based

upon the knowledge and level of commitment they can make based upon where they are.

Moreover, when we evaluate accessibility to the market segment, you can

consider if the prospective customers are accessible to your business

depending on the buying stage. For example, buyers late in the stage might be

difficult to access as their minds are closed to

more information. It can be easier to identify where a prospect is in

the buyer journey with qualifying questions .

Examples below

| PROMPT FOR THE CUSTOMER TO RESPOND TO | LIKELY BUYER STAGE |

|---|---|

| Looking to understand more about the benefits of a CRM system? | Likely early in the journey – aim to inform the prospective customer of the benefits and roadmap and offer to partner with the customer in their evaluation |

| Still looking for the right CRM system? Overwhelmed by too many CRM options? | Further in the buyer journey but undecided |

| Has your CRM been underperforming for too long now? | Likely experienced with CRM systems but may be looking to make a change |

Usage segmentation

Usage segmentation aims to segment a market based upon the type of

usage the customer will make of the value proposition.

As an example, consider, power tools.

Power tools might be purchased by professionals and the occasional

weekend Do-it-yourselfer.

Putting together a compelling value proposition with superior performance,

low total cost of ownership, durability and reliability is likely

less valuable to the occasional DIYer,

but much more valuable to the heavy professional usage person.

Consider a second example software. Software consumer of a business

automation solution for use in a non-critical low value

business process will be in a different segment that those looking to use it

in high volume, business essential process automations.

Usage segmentation considers:

How customers are using your product or service

How often they use it

How much time they spend with it

What features they use

How many users from the same account use it?

Usage-based segments can include:

-

High frequency / importance users - Customers that most depend upon and spend the most time using your product or service, and purchase most frequently

-

Medium frequency / importance users - Customers that regularly, but not very frequently, use or purchase your products (often time- or event-based – tax time, seasonal

-

Low frequency / importance users- Customers that use or purchase much less than other customers, sometimes even only once

Event trigger

Event trigger segmentation aims to segment a market based upon the types of trigger events that drive the desire for the value proposition of your business. If you sell Pizza’s then Friday night might be a trigger or the day of the football finals. If you sell CRM systems, then the appointment of a new CEO, marketing executive or loss of a major account might be a trigger to stimulate the need. Finally, if you are retailer then festive seasons are a recurring event trigger.

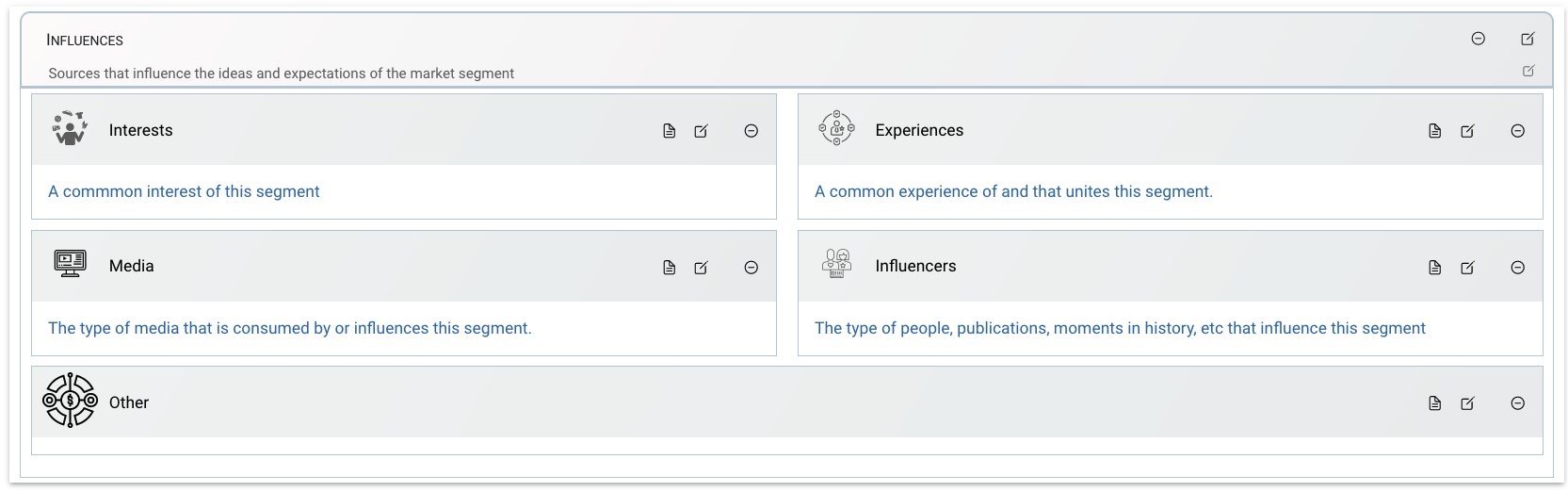

Experience segmentation

Experiences is another way to segment customers behaviorally. Some of the most common include:

| Category of experience | Description |

|---|---|

| No awareness and no experience | May need to be made aware that they have a problem in the first place |

| Some awareness and no experience | Need to learn why your product or service is their best option |

| First-time usage | Might need further instruction on how to get the most value from your product |

| Regular users | Ongoing nurture of the relationship Maybe candidates for product development growth via supplemental products or services you offer |

| Toward defectors | Customers dissatisfied with a competitor who might go back to the originating brand fixes the issue that caused them to leave. Alternatively, a competitor maybe in service delivery, reputation or other trouble and there is the chance to offer their existing customers salvation |

| Away defectors | Former customers who have switched to a competitor who might come back to your brand if you’ve fixed the reason for them leaving |

| Non-customers | Potential customers who have the need, but their unfavorable experiences have made them non-customers |

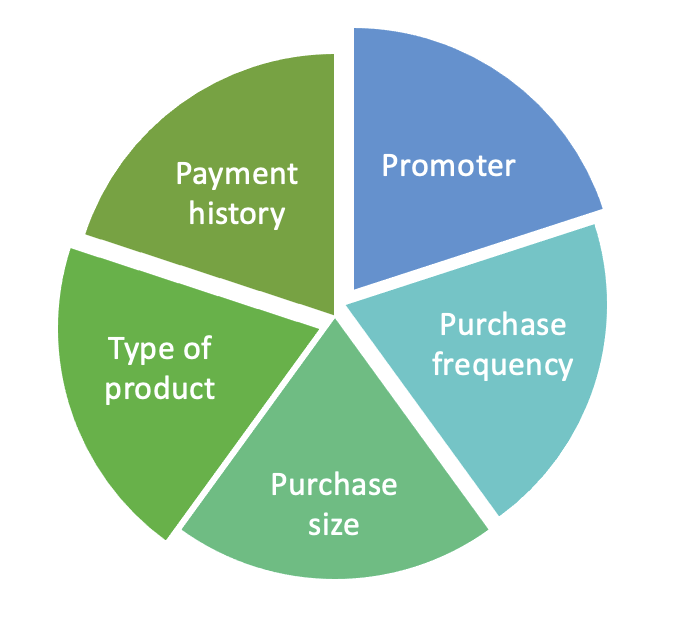

Customer loyalty

Customer loyalty is technical part of a customer segment. A Customer segment is how you might partition your existing customers. It is mostly an academic difference because you will frequently segment customer segments as you would a market segment, but customer loyalty, purchase frequency, purchase amounts, customer satisfactions are additional segmentations for existing customers. There could be multiple ways to partition customers based upon loyalty including:

Promoter

Promoter of your business (> 8 on a Net Promoter Score)

Detractor (<7 on a Net promoter score)

Neutral (neither positive nor negative 7 or 8 on Net Promoter Score)

Purchase frequency:

High purchase frequency

Medium purchase frequency

Low purchase frequency

Purchase size:

Large purchase

Medium purchase

Low purchase

Type of product

Premium

Standard

Payment history

Reliable / timely

Unreliable / untimely

Firmographics

Segments a B2B market based upon the type of organizations being targeted e.g., Fortune 50, 500, SME, start-ups, government, non-government and so on. Organizations can be segments based upon:

Industry(ies) operated in e.g. the Chemical engineering industry versus the Pharmaceutical industry

Location or Geography

Size (e.g. number of employees)

Structure (public companies, privately held, fortune 500 or 2000)

Status – market leaders, aspiration leaders, startups, favorable reputation

Performance (Growing, Stagnant, Declining, Gained a particular round of venture capital)

Wrapping up the segment definition

At this point, you have seen multiple ways to define one or more target segments. The attributes of one or more target segments are now well defined. The remaining questions are can your business access and target these segments and if so, how will it do so? To answer these questions in the next sections, you can assess targeting feasibility and positioning approaches to win with your specified segments.

Assessing the market segment

Assess the accessibility and financial returns available from the defined segment.

| Attribute | Favorability | Assessment |

|---|---|---|

|

Accessibility |

High | Medium | Low |

Are the people in the market segment accessible to your business |

|

Size |

High | Medium | Low |

[Is the market of sufficient size to make a return Is the market one the value proposition can win in and then expand?] |

|

Profitability |

High | Medium | Low |

[Is the market expected to be profitable? i.e., the revenue from a customer will exceed cost of acquisition and cost of goods sold] |

|

Channels |

High | Medium | Low |

[What type of channels will be necessary to create awareness, promote, sell, deliver and support the value proposition for this segment] |

|

Advantages |

High | Medium | Low |

[What advantages does your business have in this market segment e.g., existing reputation, partnerships, that would allow it to succeed / win] |

|

Challenges |

High | Medium | Low |

[Challenges and risks for this business in this market] |

Ideally, your segment is assessed as readily accessible of an acceptable size and profitability. Channels necessary to deliver your value proposition are accessible. If accessibility, profitability and too many other factors are low accept for challenges this segment may not be the right choice. Consider a different segment.

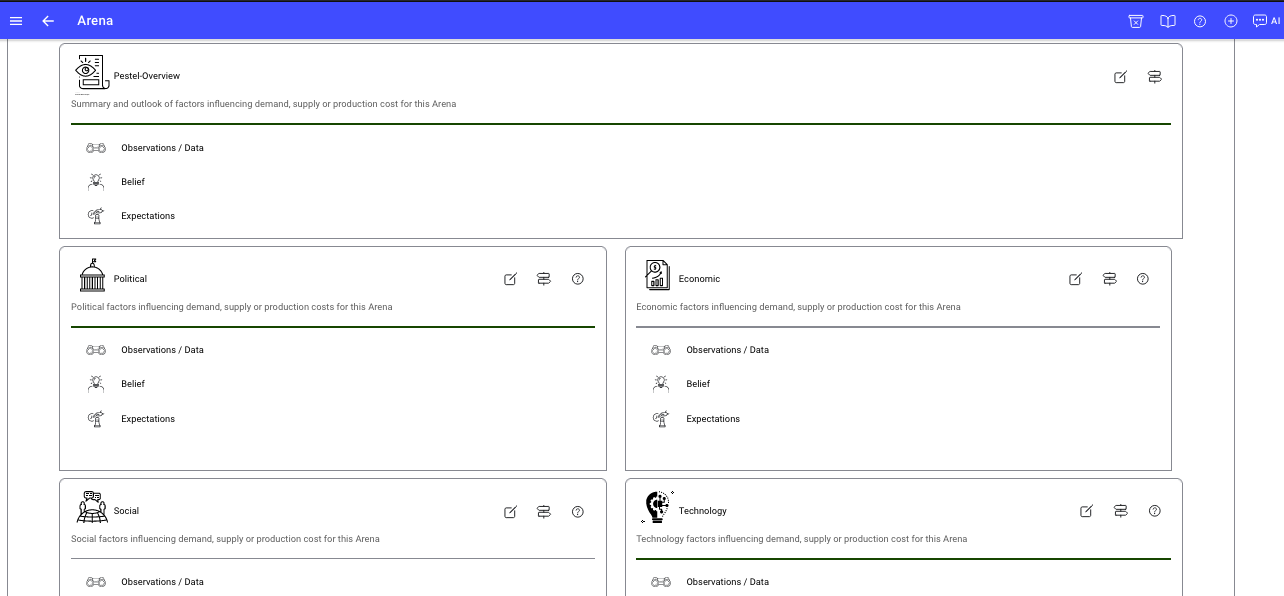

The business environment of today is much different than it was even

5 or 10 years ago.

To both stay relevant and skate to where future business is going to be,

strategic leaders can use a PEST(EL) analysis.

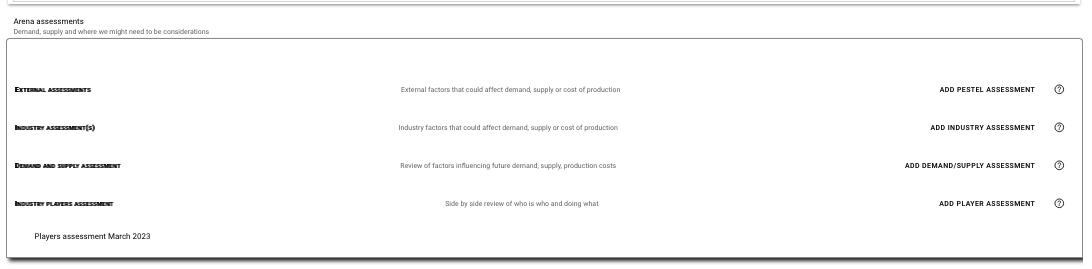

To add an assessment, from within the Assessments section of

the Define tab of the Arena canvase - choose Add PESTEL Assessment

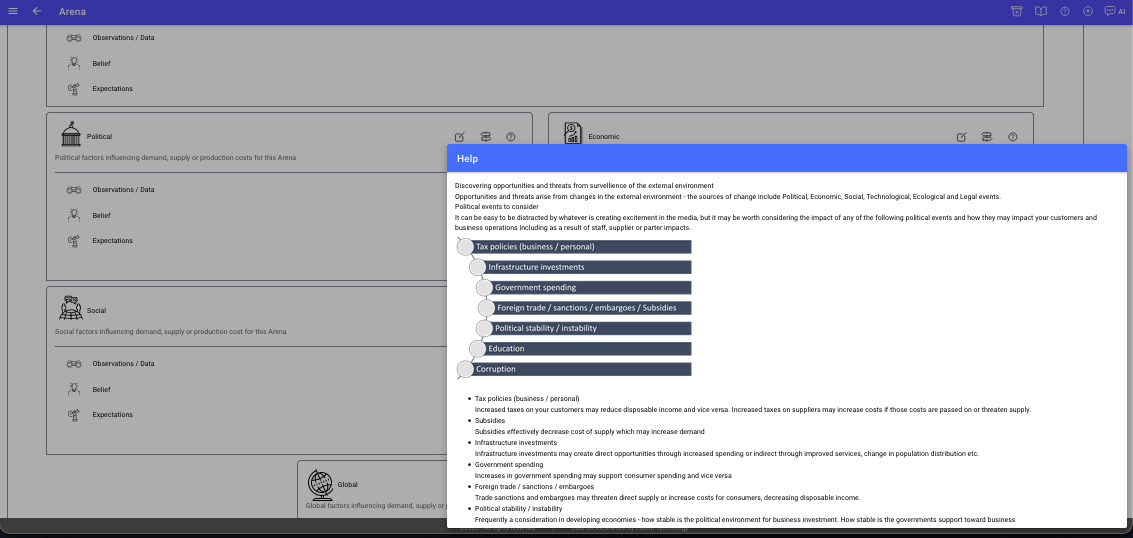

PESTEL stands for the political, economic, socio-cultural, technological, environment and legal aspects of a business environment. In a PEST(EL) analysis you audit these factors to gain insights about your where to play or potential new environment. Just as Porter’s 5 forces helps evaluate the attractiveness of a specific industry, PESTEL analysis helps evaluate the attractiveness of the larger global environment in which that industry operates.

You find help on each of the PESTEL elements available from the help

icon

on the cards in the assessment.

Color coding your environment

As you assess each dimension of the external environment, you can color code it to provide a quick color visual (heat map) of that environment.

Color coding dimensions of

the industry environment

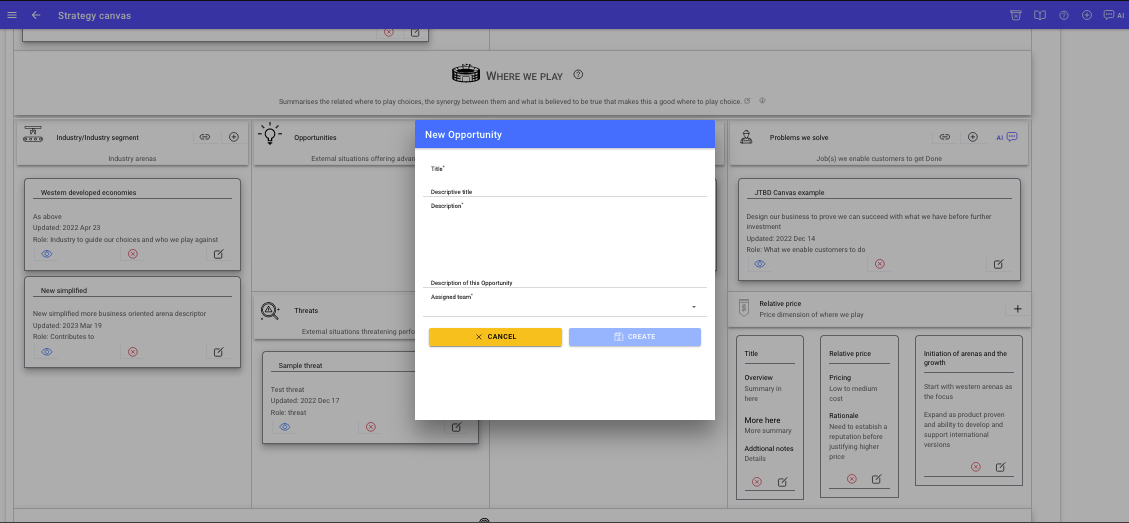

Adding opportunities and threats

The purpose of any assessment is gain insight into opportunity to expand

or evolve your business value proposition or identify threats to it.

You can add identified opportunities or threats to your Strategic

choices canvas

from the Opportunities or Threats section.

You can then add identified opportunities or threats to your Strategic

choices canvas

from the Opportunities or Threats section.

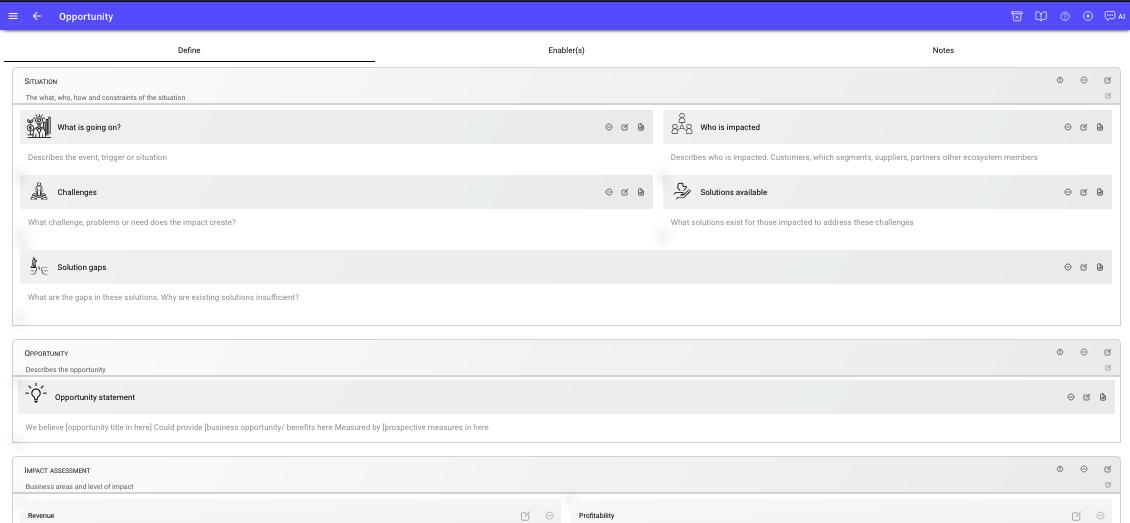

You can then elaborate the situation and impacts of an opportunity or

threat

using the related canvas.

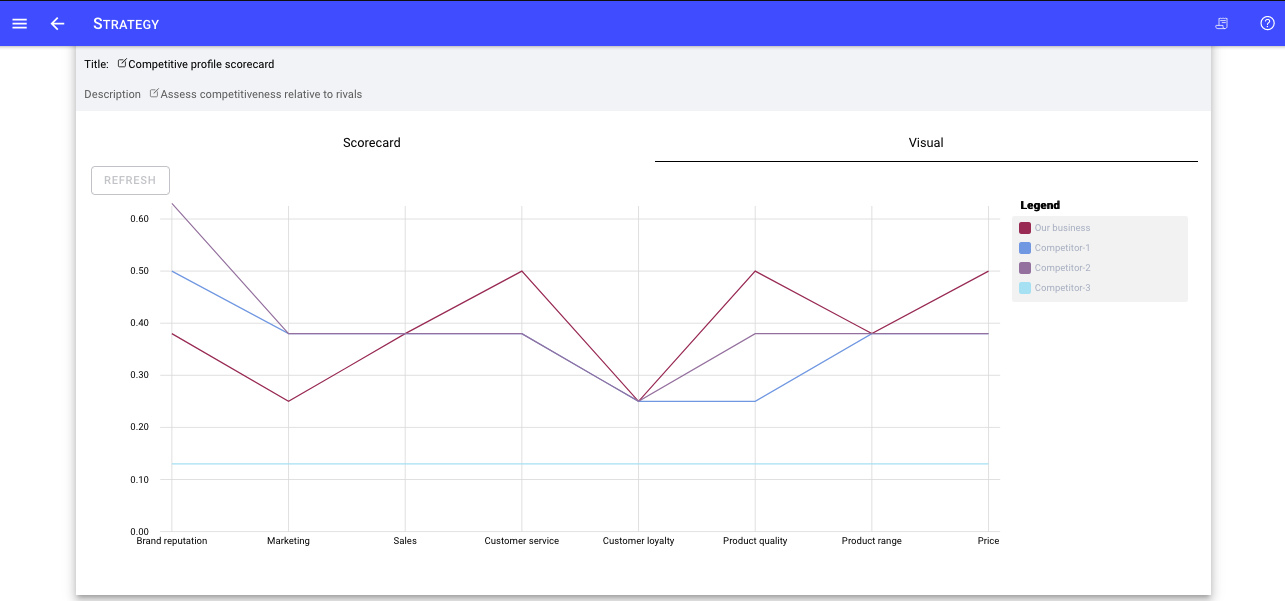

A competitor assessment enables you to build a profile of each player in an industry environment and then identify potential opportunities and threats as a result of how each rival in a market is playing. For example, if more rivals are moving into your relative price or with similar Unique Selling / Value propositions, this is a candidate threat that requires a strategic response. Alternatively, if a relative price or value proposition is missing this may represent an opportunity.

Adding an assessment

To add a Competitor assessment, from within the Assessments section of the Define tab of the Arena canvas - choose Add Player Assessment

An assessment with default assessment criteria will be generated once you provide a title for the assessment

You can edit and modify these attributes along with add additional attributes or remove some that you do not need.

Ultimately, all assessments are audits to identify potential for where there will be increased or decreased demand or increased or decreased supply. As supply exceeds demand, prices will reduce or competitiveness will increase. The demand and suppy assessments enable you to review the factors which affect industry supply and demand to form a hypothesis about opportunities or threats from where supply and demand are headed

Adding an assessment

To add a Demand and Supply assessment, from within the Assessments section of the Define tab of the Arena canvas - choose Add Demand / Supply Assessment

References

|

Handbook of Market Segmentation: Strategic Targeting for Business and Technology Firms, Third Edition (Haworth Series in Segmented, Targeted, and Customized Market) 3rd Edition, 2004, Art Weinstein |

|

Articles on Market Segmentation, 2023, Management Study Guide |

|

|

|

Segmentation, targeting and positioning, 2023, Three Brains.com |

|

How do you use segmentation, targeting, and positioning (STP) to tailor your marketing strategy? , LinkedIn |