In this section

-

Define common types of Strategic alliances (partnerships)

-

Differentiate between when partnership are superior to supplier arrangements.

-

Use the StrategyCAD™ Partner canvas to record, and represent the value of a partnership

-

Introduction

Define partnerships and potential benefits

-

Types of partnerships

Describe the different types of partnerships available

-

Partnerships vs suppliers

Differentiating partners from suppliers

-

Defining partnerships

Recording and define partnerships in StrategyCAD™

Definition

A partnership or strategic alliance is formally described as a cooperative arrangement in which two or more firms combine their resources and capabilities to create new value.

Why Partnerships

By forming strategic partnerships, businesses can gain access to new markets, technologies, and resources that can help them grow and expand. Partnerships can also help companies reduce costs, increase efficiency, and improve their competitiveness in the marketplace. In addition, partnerships can provide opportunities for knowledge-sharing and innovation, allowing businesses to develop new products or services that can better meet the needs of their customers. Overall, partnerships can be a valuable tool for businesses looking to achieve their strategic objectives and drive long-term success.

Benefits available

Strategic alliances can be valuable enablers to achieve competitive outcomes including:

Lowering costs

Tesla could make its own batteries or buy them from a firm that specializes in Lithium battery production.

Tesla would likely choose to buy the batteries because the specialist firm can make them cheaper.

Tesla might choose to create a partnership because, the battery is a profoundly important component of the electric vehicle. Tesla probably would NOT partner with the supplier of the wheel nuts or other commodity components because they can buy those anywhere.

Tesla might one day choose to create its own batteries, but it might not ever decide to mine its own lithium as it lacks the resource and capabilities to do so. Again specialist Lithium miners can do so cheaper and lower risk. Producers of lithium batteries could have lithium suppliers or partnerships.

Creating new sources of differentiation

Before Disney acquired Pixar, both were in a partnership. By combining capabilities and resources they were able to bring new value. Pixar had technology (that exceeded even Disney) to make animated movies, branded characters, demonstrated capability for creating box-office success stories. Disney had global distribution, theme parks and stores. Where now fans could see their favorite Pixar movies world-wide or have a photo taken with Buzz Lightyear at a Disney theme park.

Amazon and its cloud services business partners with multiple technology providers to provide those technology vendors solutions on its cloud. This creates new value for consumers of the cloud services where they can access specialist vendor products. Additionally, it creates an additional channel for the vendors to have their offerings consumed. Finally, it increases the value proposition of the AWS cloud.

Entering new markets

Entering a new market can be both costly and high risk. A different environment, culture, market expectations, laws, and relationships necessary to succeed can be costly to acquire, learn and add to the risk of entering the new market.

Partnering with a firm who has the resources and capabilities to augment the probability of success and decrease the cost, is valuable. For example, fast food chains (e.g. KFC) entering China partner with Yum Foods.

Reducing risk associated with any of the above

Partnership arrangements reduce by sharing risks between each firm in the partnership.

A previously introduced a competency is "Know-how" - Expertise an organization has that enables it to deliver value to the community and stakeholders it serves. For example, in their book Playing to Win: How strategy really works A.G. Lafely and Roger Martin identified the competencies or strengths they identified for Proctor and Gamble. These were:

Nonequity or Contractual Alliance

A contract specifies what each partner is to do in the alliance and what each party will receive when it fulfills its obligations in the partnership. Contractual alliances, are preferred when it is easy for each partner to make their contributions independently.

Examples of Non-equity or contractual alliancesLicensing agreements, in which one firm receives a license, or permission to use a resource, such as a brand or a patent, from another firm in return for a percentage of the revenues or profits.

Supply agreements, in which a supplier might agree to develop certain customized inputs for a customer.

Distribution agreements, in which a distributor or retailer might agree to provide certain customized services in order to help sell a product

Equity Alliance

In an equity alliance, the partners often supplement contracts with equity holdings in their alliance partners. For example, Toyota owns between 5 and 49 percent of the equity of its 10 largest Japanese suppliers, who all work very closely with Toyota in the development and production of its automobiles. For example, Toyota’s equity investments encourage its suppliers to locate their manufacturing plants next to Toyota’s assembly plants to reduce the costs of shipping and inventory. The fact that Toyota owns some equity in these suppliers means make greater cost reduction committments as suppliers can make investments that benefit Toyota, knowing that Toyota wont push prices down when the partners commitments reduce their flexibility, because Toyota have equity in the firm.

Joint Venture

Firms create and jointly own a legally independent company. The new company is created from resources and assets contributed by the parent firms. The parent firms jointly exercise control over the new venture and consequently share revenues, expenses, and profits.

Joint ventures are preferred when the partnership needs to combine their resources and capabilities in order to create a competitive advantage that is substantially different from any they possess individually.

Horizontal and vertical partnerships

An additional way to classify or identify partnership opportunities is how they fit into the industry value chain i.e from raw material collection, manufacturing wholesale, distribution, retail, service & support to disposal.

Vertical alliances

Vertical alliances join different stages of the industry value chain. Manufacturers who form partnerships with suppliers or raw materials or components is an example of a vertical alliance. Alternatively, manufactures who begin to sell and ship their product directly from their factory through an e-commerce partnership would also be a vertical partnership.

Horizontal alliances

Horizontal alliances do not have a supplier–buyer relationship and are typically positioned at a common stage of the value chain (e.g., competitors). So MongoDb or Oracle as a partner for Amazon's AWS is a horizontal alliance. As both AWS and Oracle participate at the same stage of the value chain, consumption by a consumer.

Supplier relationships work well when purchasing inputs that aren’t differentiated on anything but price e.g. office supplies.

Partnerships can be valuable when the

-

Partnership can differentiate your product in the minds of customers. Automakers are much more likely to want to partner with a supplier that provides important engine or drivetrain components that influence engine performance or reliability than one that provides fasteners. For example, truck manufacturers often partner with Cummins, a respected maker of truck engines and components, in the manufacture of their trucks.

-

Partnership can enhance your brand or reputation. Many I.T Service providers become SalesForce, ServiceNow, IBM, AWS or Microsoft Partners. Being a recognized and recommended partner of these trusted companies, increases the brand or reputation of the partner.

-

Partnership provides inputs or activities that make up a high percentage of total costs. Aircraft manufacturers are more likely to partner with the supplier aircraft engines than the suppliers of carpets for the interior.

-

Partnership provides inputs or activities that require significant coordination in order to achieve the desired fit, quality, or performance. Whenever you need to coordinate closely with another firm to get the desired performance from their input or activity, you probably want a partnership relationship. For example, automakers must typically work closely with the supplier that provides the HVAC system (heating, ventilation, and air conditioning) for a vehicle, because the supplier must know the geometric constraints in the dashboard, as well as where to run the lines to the vents throughout the car, and because the HVAC system influences, and is influenced by, the catalytic converter and other engine components.

-

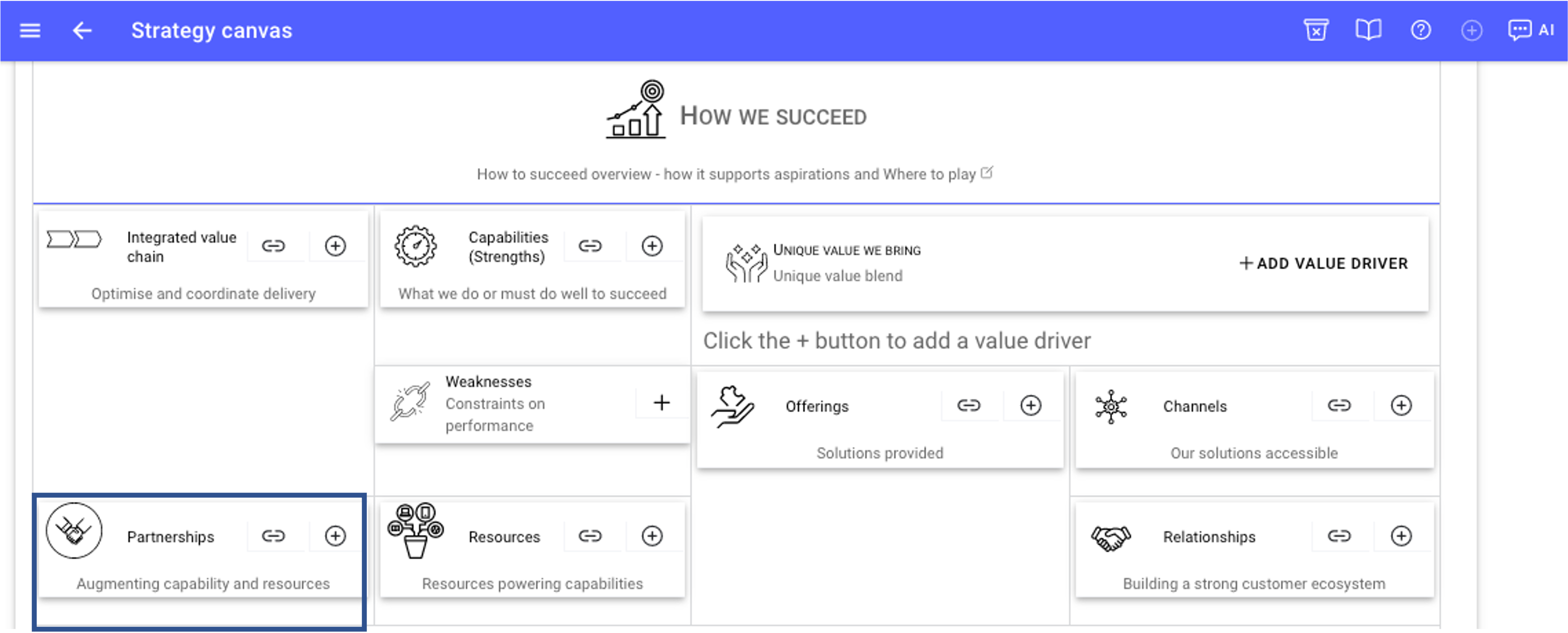

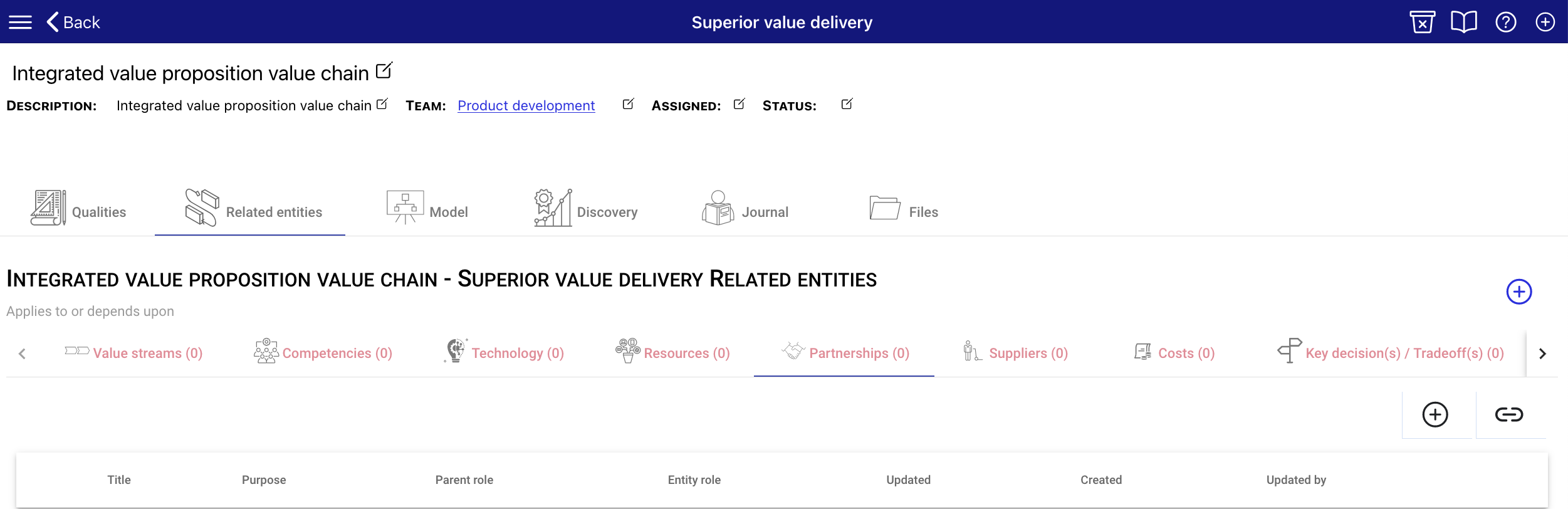

Partnerships can be added via the Related entities tab for any entity, but most particularly on the Value Integrated value delivery canvas.

If the Partnership exists then you can link to it using the link icon

.

.

Otherwise, if the Partnership does not exist tap the add icon (far right). A dialog box will appear. Record the title, description and team that will own the Partnership and submit. Once the Partnership is created then you can link to that Partnership using the link icon .

.

Adding a partnership from the Value delivery canvas