Nurturing the Strategic mindset

A Strategic mindset is the source of strategic insights for superior business performance.

A Strategic mindset is the source of strategic insights for superior business performance.

The key to successful strategy mindset is not with an obsession with the right answers, but in asking the right questions. Strategists subsequently make bets on what looks to be the promising opportunities, focusing resources on those outcomes that offer the maximum contribution to business performance. However, there are often many pathways forward in any situation, and it is almost impossible to know for sure which pathway is going to be best.

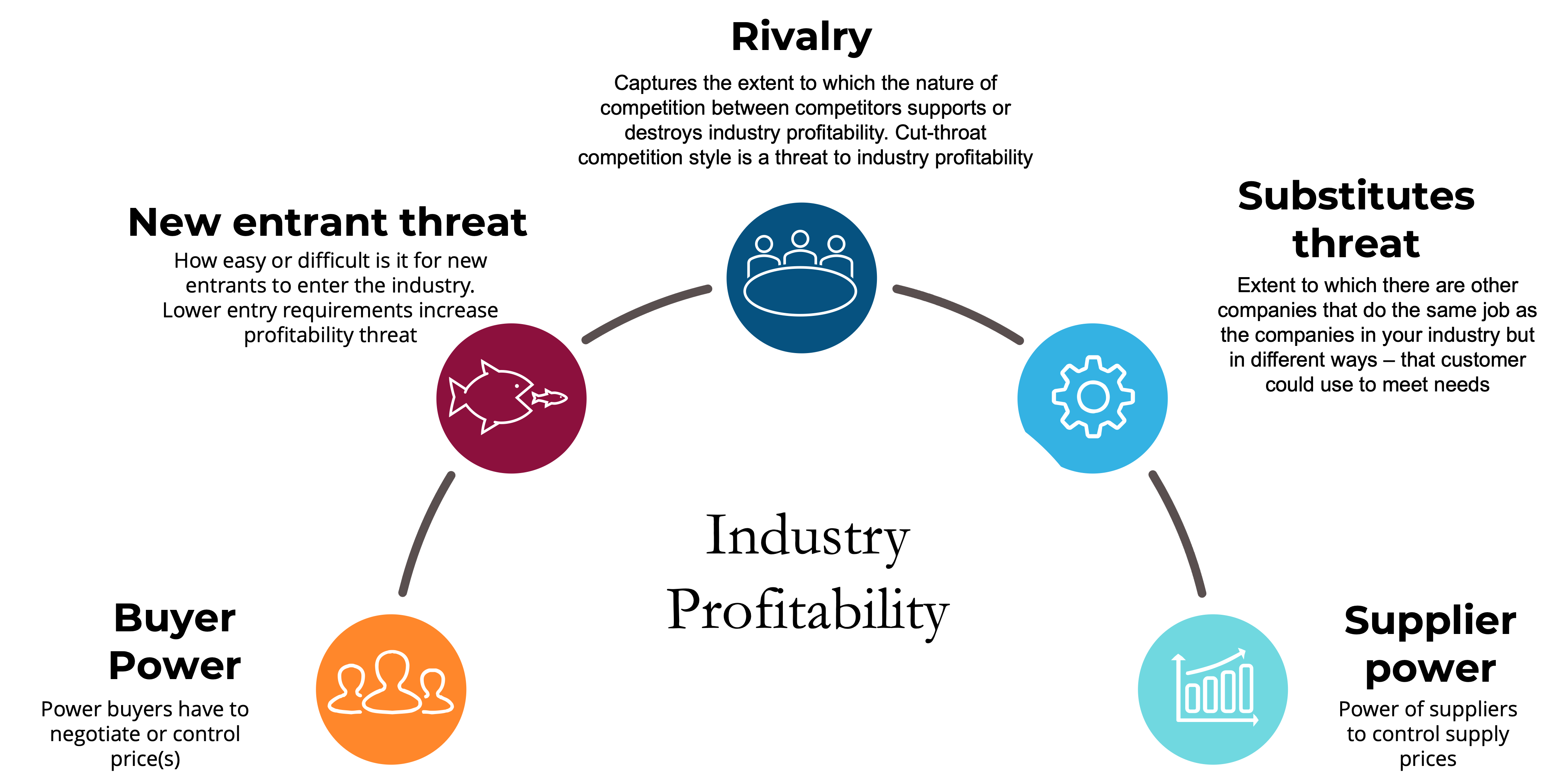

Useful strategy frameworks encourage strategists to ask good questions in hopes of leading to valuable strategic insights. For example, the classic strategy tool for industry analysis (Porters Five Forces Framework) provides a framework to explore how different competitive forces shape industry profits. At the highest level, Strategists ask what are the industry forces that affect the overall profitability of an industry? The framework tells us that these forces are rivalry, threat of entrants, buyer power, supplier power, availability of viable substitutes, and complements demand.

The strategist can then ask a series of questions about each of these forces.

For buyer power, we might ask questions like:

how important our product is to our buyer?

how many other viable options our buyers have?

how costly it is for buyers to switch away from our products

what percentage of our buyers' total costs come from our products

and so forth. Answering these additional questions can help to identify the extent to which buyer power effectively threatens industry profits

When assessing the potential for suppliers to increase their share of industry profits we can ask questions like:

Based on the availability of suppliers how easy is it for the industry players to change suppliers?

Are Switching costs from one supplier to another low or high. High switching costs increases supplier power.

How likely is it that suppliers forward integrate and become competitors?

When assessing the potential of threats to profitability from new entrants looking to gain a share of industry profits we can ask questions like:

Are the Barriers to entry high or low and where are they headed: The presence of high barriers to entry, such as regulatory hurdles or significant capital requirements, can discourage new entrants from attempting to break into the market.

How important are Economies of scale: Do existing businesses in the industry may have significant economies of scale, such as lower production costs, that allow them to price new entrants out of the market.

How important is Brand recognition and loyalty? Do established competitors have strong brand recognition and customer loyalty, making it more difficult for new entrants to gain market share?

How accessible are essential industry resources? For example can new entrants access to distribution channels, supply chains or do existing players may have exclusive relationships with key distribution channels or supply chain resource, making it difficult for new entrants to get their products to market.

Are existing customers constrained by switching costs? If Customers incur significant costs to switch from established firms to new entrants, giving existing firms a competitive advantage, particularly when an industry is not in the growth but in a consolidation phase.

Overall, the questions asked aim to understand the current and trending situation in industry accessibility to new players.

When assessing the potential of threats to profitability from substitute products or services looking to gain a share of industry profits we can ask questions like:

What is the availability and the trends in availability of substitutes that can make it easier for customers to switch away from a product or service, increasing the threat of substitutes.

How price and performance competitive are any substitutes? If a substitute offers a similar level of performance at a lower price, customers may switch away from the original product, increasing the threat of substitutes.

How loyal are customers to the brands and businesses in the industry? If customers are loyal to a particular product or brand, they may be less likely to switch to a substitute, decreasing the threat of substitutes.

How important is brand in creating customer trust If a product or brand has a strong identity or reputation, customers may be less likely to switch to a substitute, decreasing the threat of substitutes.

Are existing customers constrained by switching costs? If Customers incur significant costs to switch from established firms to substitutes, this helps protect the industry profitability.

When assessing the potential of threats to profitability questions can be asked about how the competitors in an industry behave is the aggressive price competition or do they tend to play along relatively nicely with each other? To gain insights the strategist can ask question like:

How many competitors are competing for the same customers and needs? The number of competitors in an industry can affect the level of rivalry. More competitors generally mean higher levels of rivalry.

Is the industry growing, or in a consolidation or decline phase? When an industry is growing rapidly, there may be enough business to support multiple competitors. In contrast, in a slow-growth industry, competitors may need to fight for market share, increasing rivalry.

Are there opportunities for differentiation? If firms in an industry can differentiate their products or services, they may be able to command higher prices and avoid direct competition, reducing rivalry.

How easy or difficult is it for a business to exit the industry?

High exit barriers, such as the cost of shutting down operations or selling assets, can encourage firms to continue operating even in the face of low profitability, increasing rivalry.

Overall, the questions asked aim to understand the current and trending situation in understanding the number of competitors, industry growth rate, differentiation, exit barriers, and cost structure as these can all influence the level of rivalry in an industry.

Great strategists invest in deeply understanding the right questions to ask in any business situation, rather than fast hip-draw answers. Strategists are comfortable being experts of questions rather than experts of answers because they recognize how important the right questions can be for the long-term success of the business.

When Lou Gestner took over IBM in 1993, the company was in serious decline as mid-range computing challenged IBM's Big Iron product range. Wall Street experts and analysts indicated that IBM needed to be broken up to respond to the rapidly fragmenting technology industry. However, Gestner as a master of curiosity and questions spoke with customers, stakeholders, and others, realizing that in a fragmenting industry, IBM's greatest opportunity was to be the reliable source of integrated solutions. Gestner then turned IBM performance around not by fragmenting the business but by focusing it on becoming more deeply integrated to be focused on customer solutions rather than products.

Therefore, to be a great strategist, work on mastering the art of asking great questions and focusing resources on the bets with the biggest and most substantial benefits. Remember that there are rarely "right" answers, but asking the right questions can lead to strategic insights that guide high-value decisions about where to allocate resources, how to update the strategy, which new businesses to start or acquire, and so forth

A PESTEL analysis and industry assessment are crucial components of any business strategy for understanding of the external factors that can impact a business. You can conduct an assessment, for Political, Economic, Social, Technology, Environmental and Legal influences by Arena (industry and geography) - see the Discover opportunities and threats section. Use your PESTEL assessment to identify potential opportunities and threats, and develop strategies to capitalize on emerging trends, and mitigate risks.

PESTEL assessment to identify opportunities and threats within an environment e.g. geographic

An industry assessment is valuable to identify the factors influencing industry competitive forces and profitabilty. It is an important determinant of decisions to enter, exit or how to compete in different industry arenas. You can conduct an assessment, for each of the Five forces by Arena (industry and geography) See the Assess Industry profitability section of that page.

You can use the Five forces assessment tool to identify potential industry based opportunities and threats, and develop strategies to capitalize on emerging trends, and mitigate risks.

Industry assessment to identify competitive opportunities and threats within an industry environment e.g. geographic

You can identify opportunities and threats by evaluating your value proposition, value blend or capabilities and resources relative to your competitors.

This assessment is done within a strategy implementation to identify where the strategy needs to focus to succeed relative to the competition. This may influence goals within the customer value or process or capability enablement section your balanced scorecard. See the scorecards section of the StrategyCAD guide, for more information about working with scorecards and assessment. See the Assessment section for more information about competitive, product and related assessments.

You can configure scorecards to assess different criteria and maintain assessments across multiple dimensions including time to track performance.

Competitive scorecard to identify competitive opportunities and threats

You can identify opportunities and threats by evaluating the consumption chains of your business and/or products.

A consumption is the series of steps a customer needs to go through to become aware of, identify the desire for, purchase, acquire, setup, use, acquire support, and eventually dispose of your product or service.

A consumption chain assessment allows you to assess how easy or difficult your consumption chain is at different points and the identify opportunities to be easier to find, or do business with. This assessment is done within Customer assessment section of a strategy implementation to identify where the strategy needs to focus to succeed relative to competition which will influence goals within your balanced scorecard. See the scorecards section of the StrategyCAD guide, for more information about working with scorecards and assessment. See the Assessment section for more information about competitive, product and related assessments.

You can configure scorecards to assess different criteria and maintain assessments across multiple dimensions including time to track performance.

Consumption scorecard to identify competitive opportunities and threats related to how easy or difficult it is for customers to discover, and exchange value with your business.

McKinsey & Company, a management consulting firm, created the 7-S model to help client companies successfully implement their strategies. It was later featured in the book In Search of Excellence, by former McKinsey consultants Thomas J. Peters and Robert H. Waterman. The model highlights 7 important elements of organizational design to create the alignment necessary to implement the business strategy. The 7 S’s are: Strategy, Structure, Systems, Skills, Staffing, Style and Shared Values.

McKinsey 7S scorecard which can be used to assess and then drive internal alignment and capability opportunities and improvements.

See the scorecards section of the StrategyCAD guide, for more information about working with scorecards and assessment. See the Assessment section - Internal assessment for more information.

You can configure scorecards to assess different criteria and maintain assessments across multiple dimensions including time to track performance.

The Star model, like the McKinsey 7s Model helps you and your team successfully implement your strategies. The model highlights 5 important elements of organizational design to create the alignment necessary to implement the business strategy. The 5 elements are: Strategy, Structure, Processes, Rewards and People.

The Galbraith Model scorecard can be used to assess and then drive internal alignment and capability opportunities and improvements.

See the scorecards section of the StrategyCAD guide, for more information about working with scorecards and assessment. See the Assessment section - Internal assessment for more information.

You can configure scorecards to assess different criteria and maintain assessments across multiple dimensions including time to track performance.

You can quantitatively assess your ecosystem (suppliers / partners) capabilities and resources using the ecosystem assessment / scorecards for one or more of supply chain, partnerships or free form (an assessment of your design).

The Ecosystem asessment and scorecard can be used to assess and then drive internal alignment and capability opportunities and improvements across your ecosystem.

See the scorecards section of the StrategyCAD guide, for more information about working with scorecards and assessment. See the Assessment section - Internal assessment for more information.

You can configure scorecards to assess different criteria and maintain assessments across multiple dimensions including time to track performance.

Your diagnosis is part of what might be called root cause analysis, or the top of the 5 whys. Your diagnosis aims to create leverage in your strategy implementation; that is, by addressing the big rock opportunity or the big anchor constraint then the business performance improves most substantially. Competitors can play at doing 10, 20 or 100 different little or medium things, but the diagnosis creates the opportunity to address the root issue.

Example in the 1990's Lou Gestner took over a very troubled IBM. The technology industry was fragmenting and many experts indicated the IBM needed to be broken up to align with the overall industry fragmentation. Gestner, however made a different diagnosis. His diagnosis was that IBM needed to become more integrated to be prepared to provide customers with integrated solutions rather than fragmented pieces of technology. That diagnosis set a completely different policy and action plan than one of IBM needs to fragment.

To prepare for a focussed and leveraged Strategy implementation, following your assessment of internal capabilities, customer, competitors and ecosystem, you can make and record one or more diganosis.

See the diagnosis section of the StrategyCAD implementation guide, for more information.

Your guiding policy is part of your strategy kernel the heart of good strategy. Your guiding policy in StrategyCAD can include

1. Your organizational chart to describe organizational / team structure reporting and supporting lines.

2. Preconfigured and customized policies

Do more, sustain, do less and eliminate policy matrix

All policies are essentially of this structure. What does the business need to do more of and sustain to deal with the situation in the diagnosis and what does it need to do less or eliminate doing to make the capacity and deal with the situation in the diagnosis

Ansoff Growth Matrix

Ansoff Growth Matrix is an enduring Matrix for providing a policy for how a business is going to achieve growth and recognizes the level of risk in the growth policy

Additionally, you can create and configure your own policy structure.

3. Roadmaps - that define the sequence of outcomes and the role of the internal alignment topics e.g. systems, people, skills, shared values or any other attributes you wish to add.

Policy view

Roadmao view

See the diagnosis section (Guiding policy sections) of the StrategyCAD implementation guide, for more information.

The balanced scorecard is a strategic management framework that helps translate strategic objectives into specific performance measures and targets. The framework provides a balanced view of performance across four perspectives: financial, customer, internal processes, and learning and growth (capability).

1. As you add objectives to your implementation action plan you can add them to a layer of your balanced scorecard to verify the feasibility of your action plan.

You can answer the question and demonstrate to your team(s) and stakeholders that based on the actions in the scorecard your business can achieve the desired business outcomes, by achieving uour customer outcomes and those customer outcomes can be achieved with the process and people objectives that have been set.

StrategyCAD Balanced Scorecard for demonstrably feasible strategy execution

Every objective in StrategyCAD is specifically structure to support the SMART Goal / objective format.

SMART goals ensure the clarity created in the strategy ripples into the goals / objectives of implementation.

StrategyCAD supports SMART objectives (OKRs) for all objectives.