Designing for superior business performance

A guide for technology, creative and startup leaders

"Don't judge each day by the harvest you reap but by the seeds

that you plant.

.”

Robert Louis Stevenson

Choice 2: Where we play - assessing and creating attractiveness

In this chapter

Why you care about understanding the forces that affect industry attractiveness.

Introduce the forces that affect the extent of success in an industry / segment.

Review the sub-criteria for each force, to enable a complete forces assessments

Tools that can help build and sustain your understanding

Introduction - Relevance

Different industries and industry segments (i.e. geography, distribution channels,

product/service types) can support different levels of profitability.

For example, during the golden years of the personal computer revolution,

thousands of businesses retailed and wholesaled personal computers. However,

nearly all of the profits went to just two companies. This anomoly was due to the

structure of the personal computer industry, most particularly the WinTel segment.

Today in the airline industry, many airlines operate on thin profit margins (< 4%).

Conversely, Airbus enjoys a profit margin of > 7%. Again, this is due to the structure of

the airline industry. It is relatively easier to create a passenger airline service, but significantly

more difficult to build a passenger jet. Hence, there are many passenger airline services,

marginally differentiated, competing on price, while there are only 2 commercial passenger

jet providers (Boeing and Airbus)

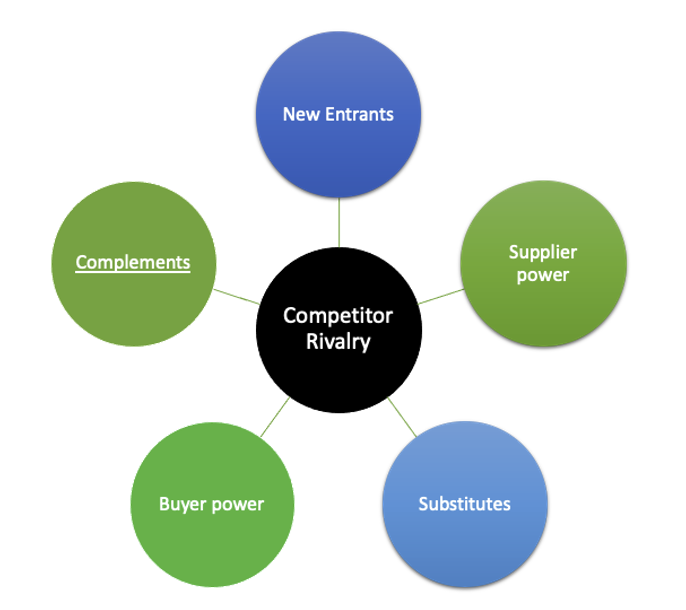

There are 5 + 1 industry forces that are valuable to understand. They are valuable to understand, because they provide you the insight to identify the factors that will affect:

- Profitability - the opportunities and threats to the level of profitability in your where to play choice.

- Demand - opportunities or threats to the demand for your offerings in your where to play choice.

- Supply - the cost of supply, particularly in the face of new or increased industry demand.

Structure forces affecting profitability in an industry

The structural forces that affect profitability and probabilities to recoup investments made in them are the combination of Porters' Five Forces - the gold standard method for industry assessment for multiple decades. Plus the newest (may be overlooked force) Complements.

You can deepen you understanding of each force understand what supports that force and how you might monitor it and keep it to your advantage in the following sections.

Graphic view of the 5 + 1 Forces.

Continue with New Entrants

Assessing the threat to profitability by new entrants

Assess and adjust the attractiveness of your where to play choice in StrategyCAD™

Try it Learn moreYou can try StrategyCAD™ free for 30 days to build your high performance strategy