Designing for superior business performance

A guide for technology, creative and startup leaders

"Government's view of the economy could be summed up in a few short phrases:

If it moves, tax it. If it keeps moving, regulate it.

And if it stops moving, subsidize it..”

Ronald Regan

Choice 2: Where we play - Assess opportunities and threats

Assess opportunities and threats from the economic trends and events.

In this chapter

Assess economic factors that can affect the demand for your value proposition, influence the attributes of your value proposition to maintain relevance and demand.

Assess economic factors that can affect your costs of production or cost of supply or supply availability.

Introduction - economic factors driving change

Describes trends or events in Economic situation / state including interest rates,

inflation, growth versus recession, currency exchange rate, employment rate.

Rising inflation, economic slowdowns for example make consumers nervous about

spending particularly on discretionary (non-essential items).

This nervousness spreads as businesses cut production in response the reduced

demand, which in turn causes B2B suppliers to cut production in response

to reduced demand.

Alternatively, a growing economy characterised by consumer, and business

confidence is likely to drive demand for many products and services.

Different industries can have different experiences at different stages

of the economic cycle. Debt collection and credit evaluation agencies may

do better in struggling economic environments for example.

As part of considering supply and production costs capture expectations

for how economic factors could influence suppliers and the cost of production.

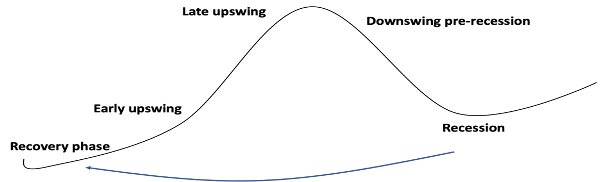

Economic cycle

Identify the point on the cycle where it seems that the environment is economically.

| Phase | Characteristics of the phase |

|---|---|

|

Recovery phase |

|

|

Early upswing phase |

|

|

Late upswing phase |

|

|

Downswing phase |

|

|

Recession phase |

|

Economic assessment

Capture, investigate and sustain (journal style) the relevant economic trends and events from the characteristics above inflation, interest rates, property and commodity prices, stock market trend, consumer and business confidence trends.

Economic phase

Economic phase influencing demand, supply or production costs in this external environment.

| Observations |

Record your observations in here e.g. Inflation rising monetary policy tightening, with rising interest rates along with falling consumer confidence What are you seeing? |

| Beliefs |

What do you believe are the implications for the industry segment from these observations? e.g. Entering downswing phase What are you believing? |

| Expectations |

What are your expectations from this / these beliefs. Example: Demand will reduce and there will be a need to reduce fixed costs in response to the reduction in demand. What are you expecting to happen? |

Continue your assessment

Continue on to the Next section to start with an assessment of what social factors could influence current and future demands for your value proposition or the cost to deliver it. You can do this for each of your where to play arena(s), or return the Guide home to choose a different option.

Advance your strategy productivity

Define, refine and implement your strategy faster, easier and better

Collaborate and conduct your external assessments as heat maps in StrategyCAD™

Try it Learn moreYou can try StrategyCAD™ free for 30 days to build your high performance strategy