Designing for superior business performance

A guide for technology, creative and startup leaders

Choice 2: Where we play - level of supplier bargaining power

In this chapter

Overview of what is the profitability threat from supplier bargaining power

Factors that elevate the threat from supplier bargaining power.

Protecting against supplier bargaining power

Overcoming supplier bargaining power

Tools that can help build and sustain your understanding

Introduction

The Bargaining Power of Suppliers, is the mirror image of the bargaining power

of buyers, except now you or the industry producers are the buyer.

It refers to the power suppliers have in the industry to raise prices,

lower quality, or reduce the availability of their products.

You may quickly think of OPEC (Organization of Petroleum Exporting Countries)

who have significant influence over the availability and price of their product.

Increased supplier power puts profitability in the industry segment at risk

because as demand increases, then the suppliers can take the increased share of the

revenues since they are free to bargain for higher prices.

If an industry is also characterised as one with high

buyer bargaining power and high supplier bargaining power then the producers selling to

consumers will have difficulty passing on the increased supplier costs to consumers. Hence,

they generate the demand, but profitability is reduced as the industry revenues are

consumed by highly powered suppliers.

Consider for example the PC industry in the 1990’s and 2000’s.

Although the PC industry experienced tremendous growth in that time,

the two powerful industry suppliers were

Microsoft and Intel who earned a substantial share of the industry revenue.

In the meantime, PC retailers and assemblers were commodity and

competing primarily on price.

The situation was so undesirable that IBM saw no future and sold its

PC business to Lenovo.

Dell made a success of the PC business by becoming a

Cost leader in customizable PC’s and smaller companies like Alienware

carved out a niche market selling high-end PC’s for game enthusiasts.

In this section you can quickly get familiar with the industry conditions that

increase your potential to be subjected to the threat of increased supplier power.

Bargaining power of suppliers is elevated when:

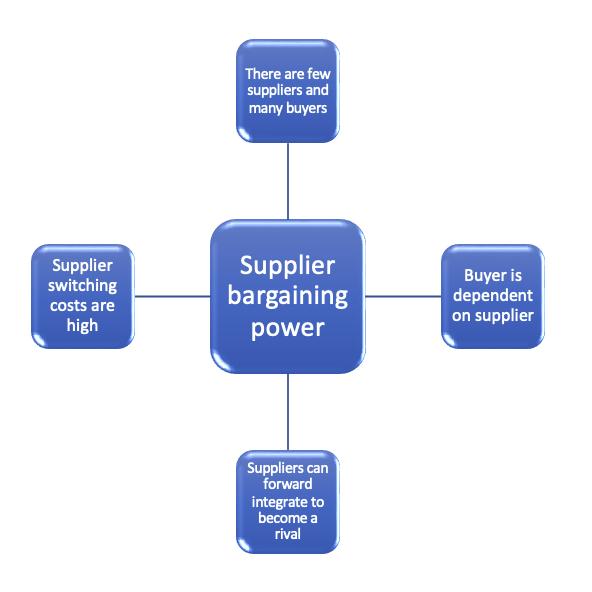

Supplier bargaining power is elevated when.

There are few suppliers and many buyers.

Buyer is dependent on supplier.

Suppliers can forward integrate to become a rival.

Supplier switching costs are high.

Review of supplier bargaining power threat factors

Most of these elements are somewhat intuitive, so you can review these factors briefly here before we move on creating and overcome supplier power barriers.

Few suppliers, plenty of buyers

Once there are plenty of buyers and significant fewer buyers then the buyers will be competing for the few suppliers. This gives the supplier the bargaining power. If they buyer does not like the transaction, there may be plenty of others who will take it.

Contrast this to the alternative, where you are the only buyer and the supplier has no other customers. Now who has the bargaining power?

Supplier switching costs are low

Switching costs are the costs that a business incurs as a result of

changing suppliers, or products.

Switching costs will usually be monetary in nature,

but also effort or time-based switching costs.

For example, once a business has it data and process automation, built into

Salesforce even if cheaper platforms are available, they are unlikely to change, because the

switching costs are so high, that the saving of the new platform may take years to pay back.

Alternatively, if the business employees fly between one state office and another then the cost of switching from one airline to another to get a better deal is negligible. In this case the airline traveller has the bargaining power.

Supplier chooses not to supply or supply less and provide the product or provide the service themselves

In B2B this is also called forward integration. Rather than only supply producers, that it

may lack some bargaining power over, the supplier decides to forward integrate

and produce the products themselves.

Google has done this with its' Pixel mobile devices. Previously, Google provided the Android

operating and ecosystem (Play store, Google pay), but has since forward integrated into being

a supplier of mobile handsets, effectively competing with Samsung and other suppliers who also

rely on its' operating and ecosystem. The fact that Google is also a supplier in the Android

mobile device industry segment, increases its supplier power as it commands market share, other

providers need to pay up, or be at risk of being cut off from supply.

Buyer is dependent on supplier

Continuing with our Android example, Manufacturers of mobile devices in the Android segment (there are effectively only 2 Apple / Android) are completely dependant upon Google for supply. The chance of Samsung or a mobile device manufacturer backward integrating to create their own mobile operating and ecosystem would be possible, but would be a long and expensive road unless there is a technology enabler. Thus these buyers are dependant on the supplier and have almost no bargaining power.

Protecting against supplier power

Protecting against supplier power is enhanced by reducing the threat factors. These are:

-

Few suppliers or supplier dependency

To the extent that it is possible, avoid getting locked into a single supplier and dependent to the extent your business is at the mercy of a single supplier. Besides, being a tactic to reduce supplier bargaining power, it also reduces business risk if an untoward event affects the viability of the supplier or their supply.

-

Forward integration

This is effectively a supplier becoming a new entrant. So the new entrant defences also apply. Additionally, rather the allowing a supplier to become a competitor, if options exist to become partners and the partnership looks beneficial, this may be superior to having a supplier as a competitor.

-

High switching costs

If the cost of switching is high and your value proposition is locked to a supplier, then they may make more sense to be a partner than a supplier.

Identify the high switching costs as a business risk and manage the risk to reduce the impact of switching.

Continue with assessment of substitutes threat

Assess and adjust the attractiveness of your where to play choice in StrategyCAD™

Try it Learn moreYou can try StrategyCAD™ free for 30 days to build your high performance strategy